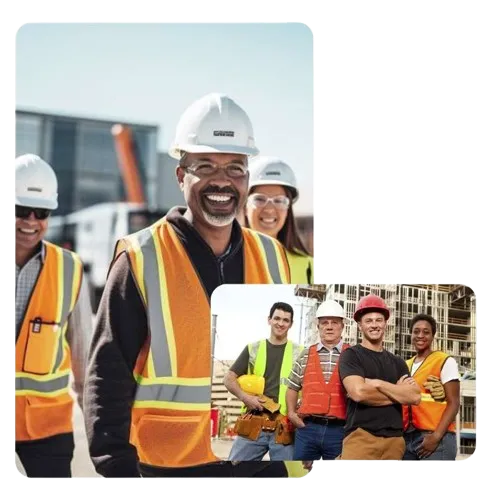

Insurance Solutions Tailored for Contractors

Fast, Reliable, and Affordable Coverage to Protect Your Business

Get Bonded and Insured with Confidence.

Commercial Auto Insurance

Protect your work vehicles against accidents and theft

Fleet and single vehicle policies available.

Plans Built Around Your Business, Not the Other Way Around

Your work is unique — your insurance should be too.

We customize coverage to fit your business, so you only pay for what you need — and nothing you don’t.

Tailored. Flexible. Contractor-focused.

From Quote to Coverage - in Just 3 Steps

Request Your Quote

Fill out a quick form or call our specialists, it takes just a few minutes

Get Matched & Approved

We find the best coverage option at the best rates.

Get Covered & Get to Work

Same-day certificates available for many contractors.

Your Partner in Protection—For Every Milestone, Every Moment

We believe contractors deserve insurance that works as hard as they do.

With decades of combined industry experience, we simplify bonding and insurance so you can focus on building, not paperwork.

We’re proud to protect the businesses that build America.

Unmatched Speed

We deliver fast quotes and instant policy issuance where possible.

Affordability

No hidden fees. No confusing jargon. Just clear, affordable rates you can't fine elsewhere.

Real Expertise

Our team specializes in contractor insurance. We know what you need for state licensing, project bids, and peace of mind on the job site.

Committed to Protecting the Contractors Who Build America

Founded by insurance veterans who specialize in contractor needs, we have built our agency to provide better, faster, more affordable coverage solutions for the people who keep our communities running. We know the contracting world inside and out — and we know how important it is to stay protected without being buried in paperwork.

Values We Stand By:

Integrity First

Speed Without Sacrificing Service

Solutions, Not Sales Pitches

Long-Term Partnerships, Not One-Time Deals

Common Myths About Commercial Insurance

"A contractor license bond is just optional extra coverage"

Reality: In California, a contractor license bond is required by law to get and keep your contractor license. No bond = no license.

"Personal auto insurance covers my work truck"

Reality: Most personal policies deny claims if the vehicle is used for business purposes.

"Workers' comp is optional for small businesses."

Reality: Many states require it even if you have just one employee — skipping it can lead to big fines.

"Only risky industries need insurance"

Reality: Every business has risks — from slip-and-falls to property damage — no matter the industry.

Real Stories, Real Peace of Mind

Contractor License Bond

When I was getting ready to apply for my contractor license in California, I had no idea I needed a license bond. I called around, and most places either didn’t explain anything or quoted me high rates. These guys walked me through it, explained why it’s required, and got me bonded the same day for way less than I expected. They sent the bond directly to the CSLB. Super smooth process — made a stressful situation easy.

Bundled Coverage + Customer Support

I used to carry separate policies for liability, workers’ comp, and auto. It was a mess — different renewal dates, different companies, and no one to talk to when I had a question. This team helped me bundle everything under one roof, saved me over $1,200 a year, and now I’ve got one person I can call for anything. It’s way easier to manage and I feel way more protected.

Fast Turnaround & Job-Site Ready

I was about to start a new job but needed proof of insurance and my COI fast. I requested a quote in the morning, and by the afternoon, I had my certificate in hand. The client was impressed, and I didn’t lose the job. That kind of speed matters when you’re a contractor — and these folks delivered.

Smooth & Stress-Free Process

I’ve been in the business for over 15 years, and getting insurance and bonding has always been a hassle. But these guys made it so easy! From the quote to the paperwork, everything was handled quickly and professionally. I even got a discount by bundling my general liability and workers’ comp policies. Now, I can focus on growing my business instead of worrying about my coverage.

Affordable & Custom Coverage

I was hesitant at first because I thought business insurance would be out of my budget. But after talking to their team, I realized I could get affordable, custom coverage. They helped me get the right policies for my plumbing business, and I’m now covered for things I didn’t even think about, like property damage and contractor liability. Plus, they’re always available for questions.

Fast Bonding for California Licensing

I had no idea how important a contractor license bond was until I needed one to get my license in California. These guys explained everything in detail and made the process simple. I was able to apply for my license right away without delays. Their customer service was outstanding, and they had me bonded in less than 24 hours. I couldn’t have asked for a better experience.

FAQs

What is a contractor license bond, and do I need one?

A contractor license bond is required by the state of California to obtain or renew your contractor license. It ensures that you’ll comply with state regulations and protects consumers if you fail to meet contractual obligations.

What’s the difference between general liability insurance and workers’ compensation?

General liability insurance covers third-party injuries or property damage caused by your business operations, while workers' compensation covers medical expenses and lost wages for your own employees if they’re injured on the job.

Is workers' compensation insurance required for my business?

Yes, in California, workers' compensation insurance is required for all businesses with one or more employees. Even if you're a sole proprietor, you may need to provide workers' comp coverage if you hire subcontractors or temporary workers.

How quickly can I get my insurance or bond?

We offer same-day coverage for most policies and bonds, including contractor license bonds, general liability, workers' compensation, and commercial auto insurance.

Can I bundle insurance policies for savings?

Yes! We offer discounted rates when you bundle multiple policies like general liability, workers’ comp, and commercial auto insurance together. Contact us to learn more about bundle options.

How do I get a quote?

Getting a quote is easy! Simply fill out the form on our website or give us a call. Our team will help you get a fast, customized quote based on your specific needs and business requirements.

How much is the contractor license bond in California?

The required bond amount for contractors in California is $25,000. This bond must be filed with the CSLB before you can apply for or renew your contractor license.

What does the contractor license bond cover?

The bond protects consumers by guaranteeing that contractors will follow state laws and complete their contractual obligations. If a contractor fails to meet these obligations, the bond can be used to cover damages or violations, such as faulty construction work.

What happens if I don’t maintain my contractor license bond?

If you fail to maintain your bond or cash deposit, your contractor license can be suspended or revoked by the CSLB. It's crucial to ensure the bond is active and up to date to avoid any disruptions in your business operations.

Still Have Questions? We’re Here to Help.

Get Clear Answers and Friendly Guidance from Our Insurance Experts

Address:

200 Spectrum Center Dr STE 300, Irvine, CA 92618

Contact

CA License # 4426496