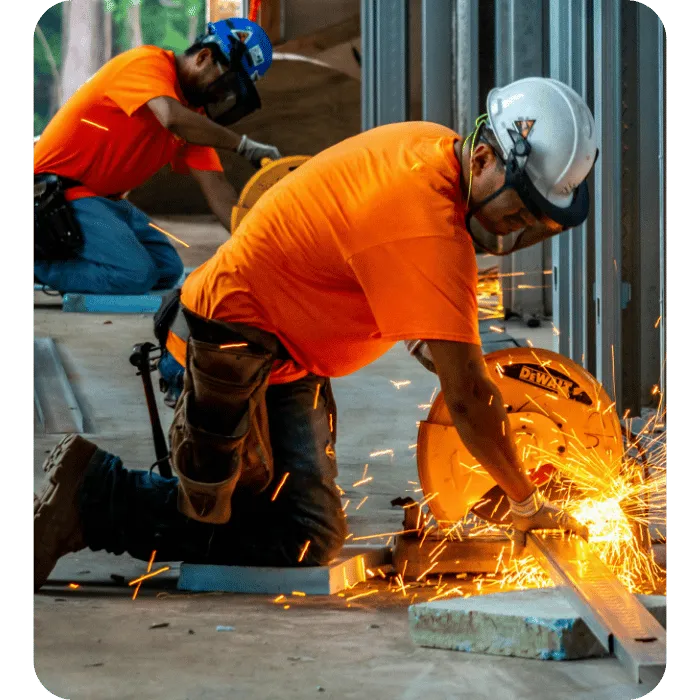

Protect Your Team. Protect Your Business.

Get workers’ comp coverage quickly, affordably, and with confidence—trusted by businesses across California.

Why Workers’ Compensation Matters

When a worker gets injured on the job, workers’ compensation insurance protects everyone. It covers medical bills, lost wages, and shields your business from costly lawsuits—showing your team that safety comes first.

In most states, it’s not just smart—it’s the law.

Our Workers’ Comp Solutions

Fast & Simple

No endless paperwork. Our streamlined application process lets you get a quote in minutes and bind coverage quickly.

Competitive Rates

We shop multiple carriers to find you the lowest premium that still maintains strong protection.

Flexible Plans

Options for various business sizes and risk profiles — whether you’re a small startup or a growing enterprise.

Seamless Service

From policy setup to claims support, our team is by your side. We file, manage, and respond so you don’t have to.

Why Choose Budget Bonds?

With Budget Bonds, you don’t just save money — you save time, avoid stress, and protect your license with confidence.

Lowest Premiums Guaranteed — we compare top insurers so you don’t overpay

Rapid Approval — many policies issued the same day

Hassle-Free Onboarding — we manage filings and documentation

Expert Claims Support — guidance during the claims process

Compliance Assurance — we keep you up to date on regulatory requirements

Ready to Protect Your Workforce?

Don’t let an injury derail your business. Get covered today.

Request a Quote

Fill out our quick online form or call our team.

Get Matched & Approved

We present coverage options and help you choose the best fit.

Start Your Coverage

Once approved, your policy is active — and we handle all filings.

FAQs

Do I need workers’ compensation if I have no employees?

In many cases, yes. Some states require even sole proprietors or officers of corporations to carry coverage, especially if they work on job sites or hire subcontractors. We’ll help you determine if you qualify for an exemption or still need a policy.

How much does workers’ compensation insurance cost?

Rates depend on your industry, payroll size, claims history, and location. High-risk trades like roofing or electrical typically pay more, while clerical or administrative work costs less. We shop multiple carriers to find you the most competitive rate.

What does workers’ comp cover?

It covers medical expenses, lost wages, rehabilitation, and disability benefits for employees injured or made ill on the job. It also protects employers from lawsuits related to workplace injuries.

What’s not covered under workers’ comp?

It generally doesn’t cover intentional injuries, intoxication-related incidents, or injuries that happen off the job. We’ll review exclusions with you to ensure there are no surprises.

What happens if I don’t have workers’ compensation insurance?

Operating without coverage can result in heavy fines, stop-work orders, and personal liability if an employee gets hurt. In some states, it can even lead to criminal charges.

How soon does coverage start?

Most policies can begin the same day your application is approved. Our team handles all filings and compliance steps to activate your coverage fast.

Can I bundle my workers’ comp with other coverages?

Absolutely. We can bundle your policy with general liability, commercial auto, or bond coverage to save you money and simplify your renewals.

What if my payroll changes during the year?

No problem. Your premium can be adjusted to match your actual payroll, so you only pay for what you need. We’ll handle the reporting and adjustments for you.

Do independent contractors need workers’ comp?

Independent contractors typically aren’t required to carry workers’ comp, but if they have employees or subcontractors, they may need it. Many general contractors also require subs to show proof of coverage before starting a project.

How do claims work?

If an employee is injured, report it to us immediately. We’ll help you file the claim, coordinate medical care, and keep your business compliant with reporting deadlines.

Address:

200 Spectrum Center Dr STE 300, Irvine, CA 92618

Contact

CA License # 4426496