Coverage Built for Contractors

Explore our full range of insurance and bonding services—customized to protect your business, your team, and your tools. We make getting covered simple, fast, and tailored to your trade.

Contractor Bonds

Build Trust. Win Jobs. Stay Licensed.

Whether you're bidding on a project or renewing your license, we offer fast, reliable access to bid, performance, and license bonds. Our streamlined process gets you approved quickly—so you can focus on building, not waiting.

Best For: Contractors applying for or renewing their license, or bidding on jobs

Who is it for?

General contractors, specialty trades, new applicants, and renewals

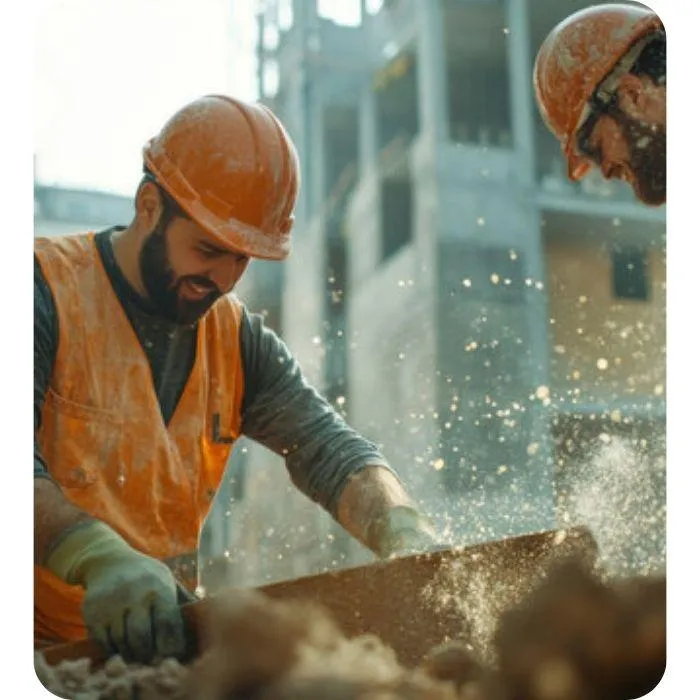

General Liability Insurance

Your First Line of Defense.

Protect your business from costly claims due to property damage, injuries, or advertising mistakes. General liability insurance safeguards your reputation and keeps your business financially secure when the unexpected happens.

Best For: Contractors working on residential, commercial, or public projects

Who is it for?

Independent contractors, small firms, subcontractors, and sole proprietors

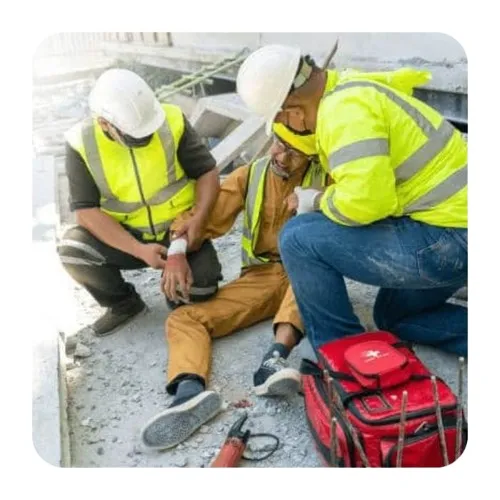

Workers' Compensation Insurance

Protect Your Crew. Protect Your Business.

Injuries on the job can lead to lawsuits and lost productivity. Workers’ comp ensures your team gets the care they need—and keeps your business compliant with California law.

Best For: Employers with one or more employees

Who is it for?

Contractors with employees, including laborers, foremen, and office staff

Commercial Auto Insurance

Keep Your Wheels (and Business) Moving.

From pickups to work vans, your vehicles are mission-critical. Our commercial auto coverage protects against accidents, theft, and damage—so your crew stays on the road and on the job.

Best For: Contractors using trucks, vans, or fleets for business

Who is it for?

Contractors with one or multiple business vehicles, from solo operators to larger crews

Affordable and Flexible Plans

Coverage that fits your budget—no hidden fees, no fluff.

Easy Application Process

Pick the protection you need, when you need it.

Tailored Coverage

Get insured in minutes with our simple, streamlined process.

Dedicated Support

Real experts ready to help—every step of the way.

Ready to Choose the Right Plan?

Request a Quote

Get a personalized quote in minutes by filling out a quick form or calling our team.

Get Matched & Approved

We find the best coverage option at the best rates.

Start Your Coverage

Same-day certificates available for many contractors.

FAQs

What is a contractor license bond, and do I need one?

A contractor license bond is required by the state of California to obtain or renew your contractor license. It ensures that you’ll comply with state regulations and protects consumers if you fail to meet contractual obligations.

What’s the difference between general liability insurance and workers’ compensation?

General liability insurance covers third-party injuries or property damage caused by your business operations, while workers' compensation covers medical expenses and lost wages for your own employees if they’re injured on the job.

Is workers' compensation insurance required for my business?

Yes, in California, workers' compensation insurance is required for all businesses with one or more employees. Even if you're a sole proprietor, you may need to provide workers' comp coverage if you hire subcontractors or temporary workers.

How quickly can I get my insurance or bond?

We offer same-day coverage for most policies and bonds, including contractor license bonds, general liability, workers' compensation, and commercial auto insurance.

Can I bundle insurance policies for savings?

Yes! We offer discounted rates when you bundle multiple policies like general liability, workers’ comp, and commercial auto insurance together. Contact us to learn more about bundle options.

How do I get a quote?

Getting a quote is easy! Simply fill out the form on our website or give us a call. Our team will help you get a fast, customized quote based on your specific needs and business requirements.

How much is the contractor license bond in California?

The required bond amount for contractors in California is $25,000. This bond must be filed with the CSLB before you can apply for or renew your contractor license.

What does the contractor license bond cover?

The bond protects consumers by guaranteeing that contractors will follow state laws and complete their contractual obligations. If a contractor fails to meet these obligations, the bond can be used to cover damages or violations, such as faulty construction work.

What happens if I don’t maintain my contractor license bond?

If you fail to maintain your bond or cash deposit, your contractor license can be suspended or revoked by the CSLB. It's crucial to ensure the bond is active and up to date to avoid any disruptions in your business operations.

Address:

200 Spectrum Center Dr STE 300, Irvine, CA 92618

Contact

CA License # 4426496